How to Track Business Expenses Without the Headache

Learn how to track business expenses the right way. This guide shares practical systems, tools, and habits for accurate financial clarity and growth.

Let's be real for a moment. That shoebox overflowing with faded receipts? Or that chaotic spreadsheet you swear you'll organize one day? That’s not a system—it’s a financial liability waiting to happen.

For freelancers and small teams, this manual approach often feels like the easiest path. But in reality, it's quietly draining your time and money. I can't tell you how many times I've heard from a designer frantically trying to piece together a year's worth of expenses hours before a tax deadline. The stress is one thing, but the financial cost is even steeper.

When you're just guessing, you end up with very real consequences. You miss out on legitimate tax deductions because that receipt for a client lunch is long gone. You make poor spending decisions because you have no clear idea where your money is actually going. Is that new software subscription delivering a return, or is it just another recurring charge you forgot to cancel?

The Hidden Costs of Disorganized Tracking

The price of disorganization goes far beyond a simple headache. It shows up as tangible losses that can seriously hold your business back.

- Wasted Hours: Every minute you spend digging for receipts or manually punching numbers into a spreadsheet is a minute you aren't spending on billable work. It's that simple.

- Missed Tax Deductions: Failing to properly document expenses for your home office, travel, or software means you're leaving money on the table—money that legally belongs in your pocket.

- Poor Financial Visibility: Without a clear picture of your cash flow, you’re flying blind. You can't spot overspending, forecast upcoming costs, or plan for growth with any real confidence.

This isn't just a small-scale problem. A staggering 71% of finance leaders admit they struggle with compliance and fraud detection because of outdated, manual methods. It's more than an administrative chore; it's a critical vulnerability for any business. You can dig into more of these business expense trends on Expenseout.com.

Bringing your expense tracking into the 21st century isn't just about making tax season less painful. It's a foundational step toward reclaiming your time, maximizing your profits, and building a financially resilient business that can actually thrive.

Building Your Financial Hub in Notion

Alright, let's get our hands dirty and build a system that actually works. Spreadsheets can feel clunky and outdated, while full-blown accounting software is often way more than a freelancer or small team really needs. This is where a tool like Notion really comes into its own, giving you a totally flexible canvas to build a financial command center that's just right for you.

We're going to skip the generic templates and build your core expense tracking database from the ground up. I find this is the best way to learn, because you'll understand exactly how every piece connects. This gives you the power to tweak and customize it down the road. The goal is a system that’s dead simple for daily use but powerful enough to give you a clear financial picture when you need it most.

Laying the Foundation: Your Expense Database

The engine of your new financial hub is a simple Notion database. If you're new to Notion, just think of it as a spreadsheet on steroids. Every row will be a single expense, and every column will be a piece of vital information about that expense.

To get started, just create a new page in Notion and choose the "Table" database option. This is your blank slate. The real power comes from setting up the right properties (which are basically just columns) to capture all the essential details for each transaction.

Here are the properties I recommend starting with:

- Expense Name (Title): A short, clear description. Think "Monthly Adobe Creative Cloud Subscription" or "Client Lunch with ACME Corp."

- Amount (Number): The total cost. Make sure to set the format to your local currency to keep things clean.

- Date (Date): The day the transaction happened. This is non-negotiable for accurate monthly and annual reports.

- Category (Select or Multi-select): This is where the magic happens for understanding your spending habits.

- Vendor (Text): Who you paid. Simple enough—Amazon, Starbucks, GoDaddy, etc.

- Receipt (Files & Media): A dedicated spot to drag and drop a photo or PDF of your receipt. No more shoeboxes full of paper!

By setting up these specific properties from the start, you’re creating a structured system that makes filtering, sorting, and analyzing your spending incredibly easy. It's the difference between a messy list of numbers and an intelligent financial dashboard.

Essential Expense Categories for Small Businesses

Getting your categories right is the secret to unlocking real insights and making tax time a breeze. A well-organized system shows you exactly where your money is going, helping you spot potential savings and identify every possible deduction. If you’re feeling stuck, it can be helpful to see how others structure their finances by exploring different types of Notion templates. You can get some great ideas for your own setup.

To get you started, here is a simple table with some of the most common—and often tax-deductible—expense categories I've seen freelancers and small businesses use.

Essential Expense Categories for Small Businesses

| Category | Description & Examples |

|---|---|

| Software & Subscriptions | All those recurring costs for the tools that keep your business running. Examples: Adobe Creative Cloud, Slack, Notion, Canva Pro. |

| Marketing & Advertising | Any money spent on getting the word out. Examples: Google Ads, social media campaigns, printing business cards. |

| Office Supplies | The physical gear you need for your workspace. Examples: Printer paper, pens, notebooks, a new ergonomic chair. |

| Client Entertainment | Costs for building relationships over meals or at events. Examples: Grabbing coffee with a potential client or a dinner meeting. |

| Travel & Accommodation | Expenses you rack up when traveling for work. Examples: Flights, hotels, Ubers to and from meetings. |

| Professional Development | Investing in your own skills. Examples: Online courses, books, or tickets to an industry conference. |

Think of these categories as the foundation. You can always add more specific ones later as your business grows.

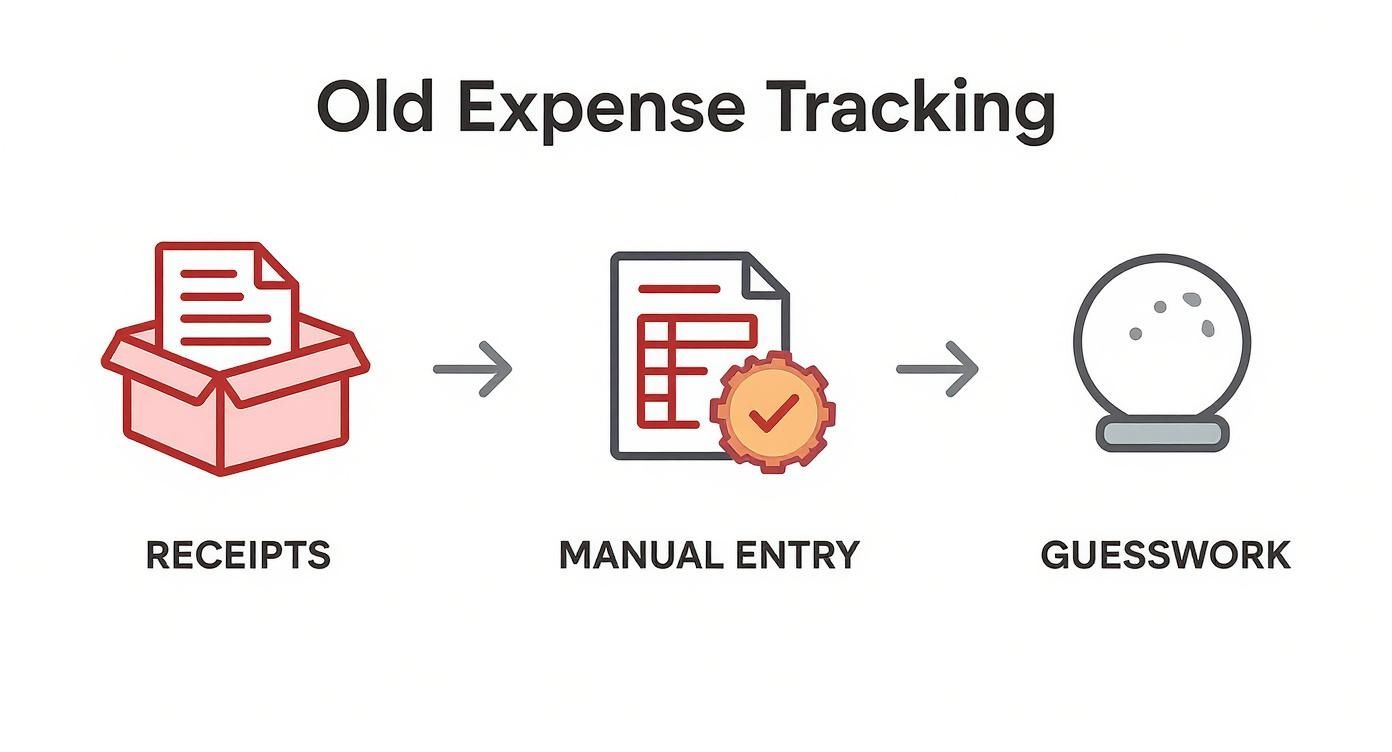

The whole point of this system is to avoid the chaotic, old-school process that so many people get stuck in. This infographic perfectly illustrates the nightmare we're trying to escape.

That messy line from disorganized receipts to pure guesswork is a recipe for missed deductions and a whole lot of unnecessary stress. Our Notion system is the antidote.

Bringing Your Database to Life

Once your database is structured, the real work begins—and it's actually pretty simple. Just hit the "New" button to add an expense and fill in the properties you created.

For example, when your monthly software bill comes through, you'll log it with the vendor name, the cost, and tag it with the "Software & Subscriptions" category. Took a client out to dinner? Create a new entry with the restaurant's name, the total on the bill, tag it as "Client Entertainment," and snap a quick photo of the receipt to upload right then and there.

This simple, consistent habit is the key. Over time, you build a rich, detailed record of your business's financial health, all in one organized place. This is the first real step toward mastering your business finances with confidence.

The Art of Consistent Expense Logging

So you’ve built the perfect Notion database. That's a huge step, but it’s only half the battle. A system, no matter how slick, is only as good as the data you put into it. The real secret to getting a handle on your business expenses is building the habit of logging and categorizing everything right when it happens.

This isn't about being rigid; it's about making your life easier. When you log expenses in the moment, you kill that dreaded end-of-month scramble. It stops being a chore and becomes a simple, two-minute task that runs in the background of your day. The goal is to make it so easy that you don't even think about it.

It's no surprise that mobile tools are taking over this space. By 2025, it’s estimated that 75% of businesses will be managing expenses primarily through mobile apps. This is all about having tools that fit our on-the-go work lives. You can read a lot more about these expense management technology trends at Softjourn and see where things are headed.

Capturing Receipts On the Fly

First things first: stop stuffing paper receipts into a folder or your wallet. Your phone is all you need. The moment you pay for something, make it a reflex to snap a picture of the receipt and upload it straight to your Notion database.

Whether it’s a coffee with a potential client or a new hard drive, this five-second action is all it takes to make sure the details don't get lost. You get the vendor, the date, the amount—all captured instantly. This is the foundation of an accurate financial record.

Tackling Tricky Categorization

Categorizing is where things can get a little fuzzy, especially for freelancers and small business owners dealing with mixed-use expenses. Let's walk through a couple of common examples that always seem to cause confusion.

- Home Office Utilities: Let's say your dedicated home office takes up 15% of your home's total square footage. This means you can generally deduct 15% of your utility bills like internet and electricity. My process is simple: when I pay the bill, I log the full amount in Notion but add a note about the deductible percentage. Then, I can create a separate, calculated entry for just the business portion, keeping everything clean.

- Mixed-Use Business Travel: You fly to a conference for three days but decide to stay for the weekend for a little personal time. How do you expense that? Because the main reason for the trip was business, your flight is 100% deductible. However, you can only write off expenses like your hotel and meals for the three business days.

The rule of thumb here is just to be honest and overly detailed. In the notes section of your Notion entry, always explain the business purpose for any mixed-use expense. This creates a clear paper trail and gives you total peace of mind come tax time.

The Weekly Reconciliation Ritual

Logging expenses daily is great, but a quick weekly review is what truly ties it all together. I recommend setting aside just 15-20 minutes every Friday to do a "reconciliation." This small habit will save you from massive headaches down the road.

Here’s what you should be doing during this quick check-in:

- Cross-Reference Your Bank Statement: Pull up your business bank account online and quickly compare the latest transactions to what you've logged in Notion. It’s the easiest way to catch anything you forgot to record.

- Check for Missing Receipts: Glance through your expenses for the week. Does that software subscription or client lunch have a receipt attached? If not, take a minute to track it down and upload it.

- Review Your Categories: Give your categories a quick scan. Did you tag everything correctly? Keeping this consistent is essential if you want to pull accurate spending reports later to see where your money is actually going.

This simple weekly ritual keeps your financial data accurate and reliable. It means that whenever you need to make a business decision or hand things over to your accountant, you're working from a clear, up-to-date picture of your finances.

Putting Your Expense Tracking on Autopilot

Manually entering every single coffee receipt and software invoice works, but let's be honest—it's time you could be spending on billable work. Once you've got a solid system down and the habit is second nature, it's time to bring in some smart automation. We're not talking about enterprise-level software with a hefty price tag. This is about using clever, accessible tools to make your system work for you and slash the busywork.

The whole point is to stop doing the same repetitive tasks over and over. Take your monthly software subscriptions—that Adobe Creative Cloud fee hits your account on the same day for the same amount every month. Why create a new entry every time? Setting up recurring entries that populate automatically is a simple tweak that ensures you never miss a thing.

Automating the Obvious Stuff

Those recurring payments are the easiest win for automation. I'm talking about the fixed monthly costs like your project management tool, web hosting, or professional memberships. A recurring entry is an absolute lifesaver here, keeping your financial records accurate with almost zero effort on your part.

This kind of organization also has a great side effect: it stops you from paying for forgotten trials or services you no longer use. If you want to get really granular, using a dedicated subscription tracker template gives you a bird's-eye view of everything you're paying for. You’ll quickly spot where you can trim the fat.

Another game-changer is syncing your business bank account. Many modern expense tools can connect directly to your bank and pull in transactions as they happen. This acts as a fantastic safety net, catching every single expense even if you forget to log something on the go.

Leaning on Smarter Tools

Beyond just setting up recurring entries, the technology available today is getting seriously smart about helping us track expenses. AI isn't just a buzzword anymore; it's a genuinely practical tool for freelancers and small teams.

- Receipt Scanning: Modern apps don't just store a photo of your receipt. They use optical character recognition (OCR) to actually read the vendor, date, and amount, then fill in those fields for you. It's a huge time-saver.

- Auto-Categorization: AI quickly learns your spending patterns. Once you categorize a few purchases from Starbucks as "Meals & Entertainment," it will start suggesting or even automatically applying that category every time you buy a latte.

- Anomaly Detection: Some tools are even smart enough to flag spending that looks out of place. If a subscription fee suddenly doubles or a weird charge pops up, the system can alert you. This is brilliant for catching errors or even potential fraud early on.

AI and predictive analytics are truly changing the game. It’s been shown that companies using AI-powered expense tracking can save an average of $75 per expense report just by cutting down on manual data entry and reducing errors.

These automations aren't here to replace your system—they're here to supercharge it. By letting technology handle the boring, repetitive stuff, you free up your brainpower to focus on what the numbers are actually telling you about your business.

Turning Your Data Into Smarter Decisions

Alright, so you’ve put in the work and built a solid system for logging every expense. This is where the magic happens. We’re about to turn all that raw data into genuine business intelligence—the kind that helps you make better decisions and actually grow.

This is the moment your diligent tracking stops feeling like a chore and starts becoming one of your most powerful strategic tools.

Expense tracking isn't just about keeping tidy records for tax season. It’s about asking the right questions and letting the numbers give you the honest answers. For example, a freelance writer I know was analyzing their software spending and had a lightbulb moment. They realized the premium grammar tool they were paying $30 a month for wasn't really moving the needle on their workflow, but a much cheaper transcription service was saving them hours of time. That's a smart, data-driven cut.

Finding the Gold in Your Numbers

Your Notion database is now a goldmine. You don't need fancy, complicated accounting software to start digging. By simply creating a few different views and playing with filters, you can generate reports that reveal some powerful truths about your business's financial health.

Here are a few practical insights you can pull out of your data right now:

- Where is the money really going? Just sort your expense database by "Category." You might be surprised to see that "Marketing & Advertising" is a much bigger slice of the pie than you initially thought.

- Are your projects actually profitable? If you've been tagging expenses to specific clients or projects, you can instantly filter to see the total cost of that work. Put that number next to the project’s revenue, and boom—you have a profitability report.

- Who's got subscription bloat? We all do. Create a view that only shows your "Software & Subscriptions" category. This gives you a clean list of all recurring costs, making it painfully easy to spot and cancel the services you’ve forgotten about or no longer use.

This is what separates simple bookkeeping from active financial management. You stop just recording what happened and start understanding why it happened—and what you should do about it next.

From Analysis to Action

Once you start seeing these trends, you can make much smarter, more confident decisions. Let's say a small agency owner notices their "Client Entertainment" expenses are creeping up month over month. That data isn't a reason to panic; it’s a prompt for a strategic question: "Is this spending bringing in new business, or can we dial it back without any negative impact?"

This whole process of reviewing and adjusting should become a regular habit. A monthly financial check-in, even for just 30 minutes, can help you catch trends before they become problems. Think of it as your roadmap for intentional spending and smarter budgeting.

For those who want to take this even further and build a truly integrated system for work and life, diving into a full suite of templates can be a game-changer. You can see how financial tracking slots into a much larger productivity ecosystem with Flowtion's Complete Bundle of Notion templates. This is how you connect the dots, turning isolated data points into an intelligent workflow that pushes your business forward.

Answering Your Top Questions About Expense Tracking

Even with the best system, you're bound to have questions. It's just part of the process. Let's walk through some of the most common head-scratchers that pop up for freelancers and small teams getting the hang of expense tracking.

What's the Best Way to Handle Cash Expenses?

Cash is tricky. It's so easy for it to just disappear without a trace. The key is to develop a habit of recording it the moment you spend it.

Think of a cash payment just like a credit card swipe. As soon as the money leaves your hand, open up your Notion database and create a new entry right on your phone. Snap a picture of the receipt, and you're golden.

No receipt? No problem. Just be extra descriptive. In the notes, jot down who you paid, what you bought, and why it was for your business. This simple discipline makes sure those "invisible" cash expenses don't fall through the cracks.

How Long Should I Hang Onto My Receipts?

This is a big one. For how many years does that shoebox of receipts need to take up closet space? The IRS generally advises keeping records that back up your income or deductions for at least three years from the date you file that year's tax return.

The smartest move you can make is to digitize every single receipt. A digital copy is just as good as the paper original, and keeping them in your Notion database means they're safe, searchable, and won't fade over time.

Having a digital archive isn't just about saving space; it's about being prepared and having peace of mind if you ever face an audit.

I Lost a Receipt—Can I Still Deduct the Expense?

It happens to everyone. You're out at a client lunch, you pay, and the receipt vanishes into thin air. Don't panic just yet.

If the expense is under $75, you can usually still claim it as long as you have other proof. A credit card or bank statement that clearly shows the vendor, date, and amount is often sufficient.

For anything over that amount, it gets a bit tougher. Your best course of action is to create a detailed record immediately. Log the date, the exact amount, where you spent it, and the specific business purpose. It's not as ironclad as a physical receipt, but it's a whole lot better than nothing.

Tired of piecing together your financial system from scratch? Flowtion provides expertly crafted Notion templates designed to give you a complete financial command center in a single click. Grab your templates from Flowtion and start mastering your business expenses today.

Related Articles

Daily Planner Templates for Notion

Discover templates for daily planner that fit your workflow. Learn how to choose, customize, and build productive habits with a flexible digital planner.

Goal Planning Templates for 2025 Success

Discover how goal planning templates can turn ambitions into clear, doable steps - start organizing, tracking, and achieving today.

Best Time Tracking Apps for Freelancers

Discover the best time tracking apps for freelancers and learn how to choose a tool that streamlines billing and improves profitability.

Did you like this article?

Discover our premium Notion templates that will help you implement these productivity systems immediately.